The DroneBase pilot network provides an affordable and scalable solution for large businesses (enterprise customers) to receive drone solutions for their national properties and assets. As an individual pilot or sole proprietor, gaining access to these enterprise accounts can be difficult - if not altogether impossible. At DroneBase, we do the heavy lifting to bring these new industries to pilots such as insurance claims on property damage.

So what is a “claim”?

Most homeowner insurance policies will provide coverage of roof damage caused by unpreventable reasons like wind and hail. The homeowner can file a claim to their insurance company to receive proper settlement for that damage. Currently, an inspector or adjuster will physically go to the site, climb a ladder, and take images to verify that claim. As you can imagine, climbing onto a roof can be dangerous and can take much longer than flying a drone to take those same images. We understand that time is money, and that is exactly where drone inspection comes in.

DroneBase has partnered with leading enterprises in the space to provide the highest quality drone inspection services for insurance claims. This is the first major deployment, specifically in the midwest where wind and hail damage is more prevalent.

A typical mission takes about 20-30 minutes and involves the same shot list for every property with a guaranteed payout of $70. The traditional inspector would usually take over an hour and be 2-3x more expensive, not including the increased safety risk standing on a roof.

By utilizing drones, the traditional inspection model has been disrupted by a technology and business model that is magnitudes better in cost, speed, quality, and safety. An adjuster can now review dozens of properties from their desk versus scaling 2-3 roofs per day. This allows for a faster turnaround to the homeowner who filed the claim. Without this tangible ROI, Enterprises would stick to their traditional method and not use drones as a cost-effective solution.

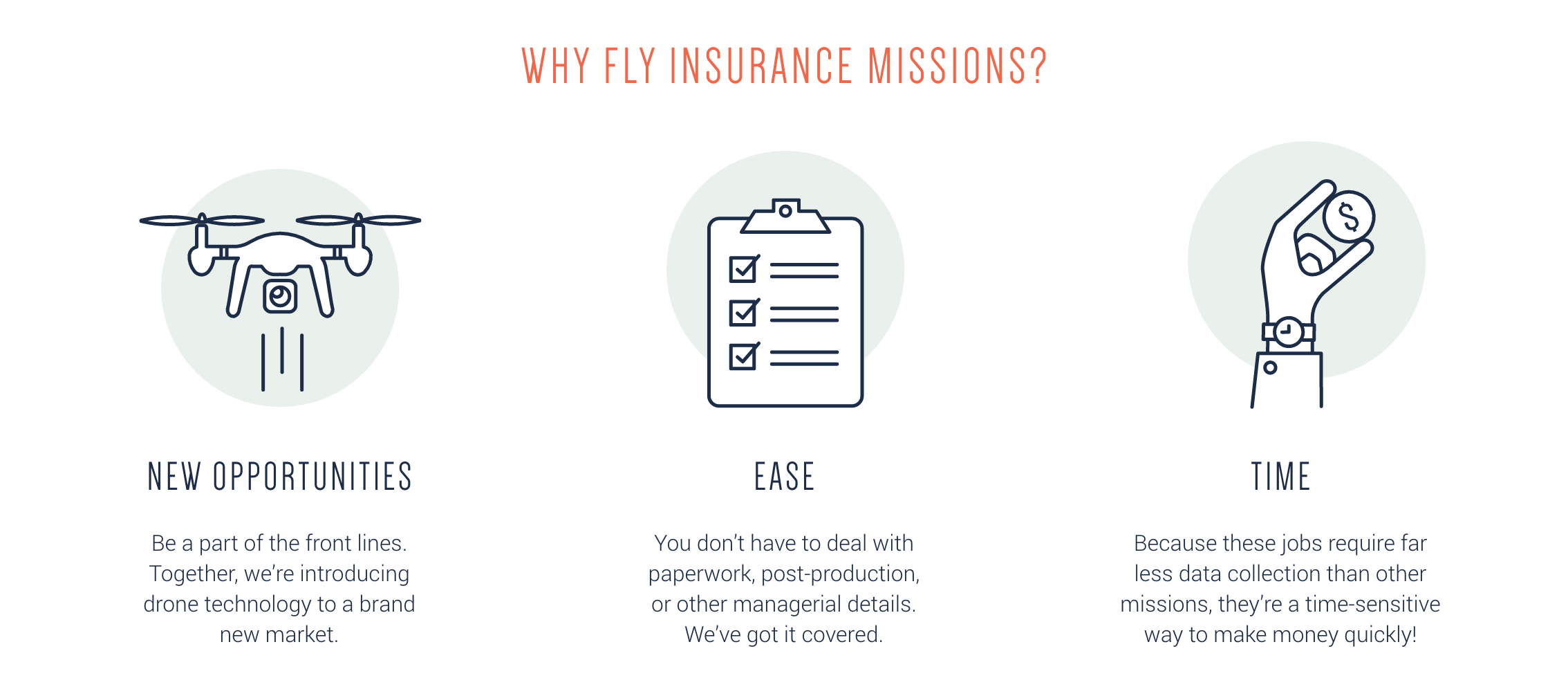

With DJI as an investor, DroneBase has set itself up as a one-stop shop for enterprises, combining cutting edge drone technology and a nationwide network of qualified drone pilots. Depending on the pilot's location and if a “natural event” has occurred, a DroneBase pilot will receive a mission notification with the address, payout amount, date/time, and shot list. If that pilot is available, they can accept the mission, fly, upload, and get paid. DroneBase takes the hassle of paperwork, post-production and other back-office tedious tasks.

For more information on becoming a drone pilot and finding missions in your area, see HERE.

.jpg)